Indicators on Nj Cash Buyers You Should Know

Table of ContentsThe Buzz on Nj Cash BuyersIndicators on Nj Cash Buyers You Should KnowHow Nj Cash Buyers can Save You Time, Stress, and Money.Our Nj Cash Buyers Ideas

The majority of states give consumers a specific degree of protection from lenders regarding their home. Some states, such as Florida, completely excluded your home from the reach of specific financial institutions. Other states established limits varying from as low as $5,000 to approximately $550,000. "That suggests, despite the worth of the house, lenders can not compel its sale to please their cases," states Semrad.If your home, as an example, is worth $500,000 and the home's home loan is $400,000, your homestead exemption could avoid the forced sale of your home in order to pay creditors the $100,000 of equity in your home, as long as your state's homestead exemption goes to least $100,000. If your state's exception is less than $100,000, a bankruptcy trustee could still force the sale of your home to pay creditors with the home's equity in extra of the exemption. If you stop working to pay your residential or commercial property, state, or federal tax obligations, you can lose your home via a tax obligation lien. Acquiring a residence is a lot simpler with money.

(https://johnnylist.org/NJ-CASH-BUYERS_274128.html)Aug. 7, 2023 In today's warm market, specifically in the Hand Coastline Gardens and Jupiter realty location, cash money deals can be king yet, there are reasons you might not desire to pay money. I understand that several sellers are a lot more likely to approve an offer of cash money, yet the seller will obtain the cash despite whether it is funded or all-cash.

Rumored Buzz on Nj Cash Buyers

Today, concerning 30% of US homebuyers pay money for their homes. There may be some great factors not to pay cash.

You might have credentials for an excellent home loan. According to a recent study by Money magazine, Generation X and millennials are taken into consideration to be populaces with one of the most potential for growth as customers. Handling a bit of financial obligation, especially for tax functions fantastic terms may be a much better choice for your financial resources generally.

Maybe buying the stock market, shared funds or an individual service may be a far better option for you over time. By purchasing a home with money, you run the risk of depleting your reserve funds, leaving you susceptible to unexpected maintenance expenses. Owning a residential or commercial property entails continuous expenses, and without a mortgage pillow, unexpected repair work or renovations can stress your funds and hinder your capacity to keep the home's condition.

The Greatest Guide To Nj Cash Buyers

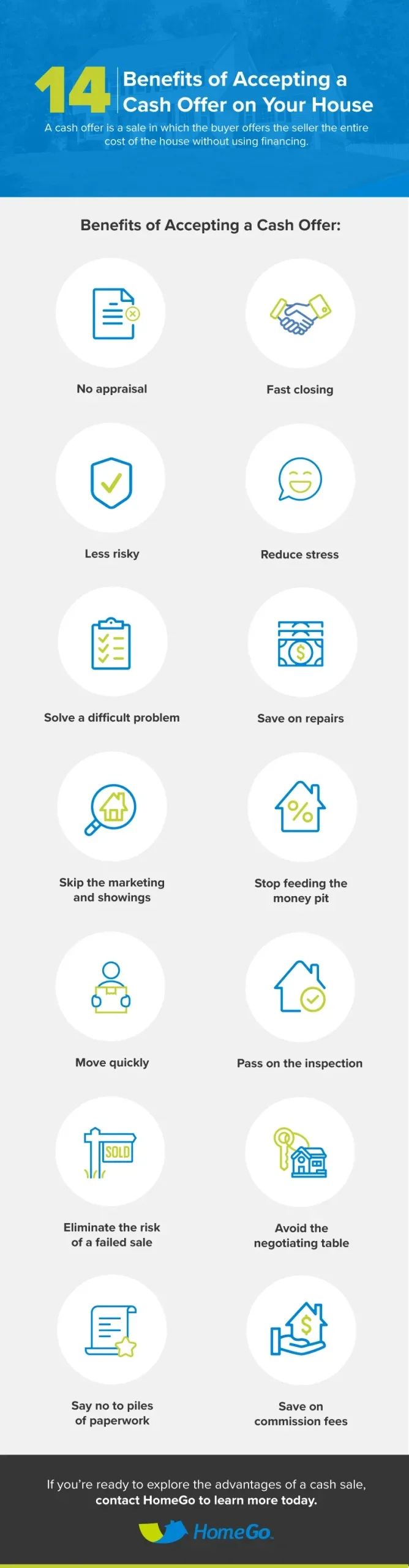

Home costs fluctuate with the economy so unless you're intending on hanging onto your house for 10 to 30 years, you may be better off investing that cash elsewhere. Purchasing a residential or commercial property with money can expedite the buying process dramatically. Without the need for a mortgage approval and connected documentation, the transaction can close faster, offering a competitive side in affordable actual estate markets where vendors might choose money purchasers.

This can lead to significant price financial savings over the long-term, as you won't be paying rate of interest on the lending amount. Cash purchasers usually have more powerful arrangement power when managing sellers. A cash deal is a lot more eye-catching to vendors given that it decreases the risk of a deal failing as a result of mortgage-related problems.

Remember, there is no one-size-fits-all remedy; it's important to customize your decision based upon your private conditions and long-lasting aspirations. Prepared to begin looking at homes? Provide me a telephone call anytime.

Whether you're selling off possessions for an investment building or are carefully conserving to buy your desire residence, purchasing a home in all cash money can substantially raise your buying power. It's a strategic relocation that reinforces your placement as a buyer and improves your versatility in the realty market. However, it can put you in an economically vulnerable area (cash for homes companies).

Our Nj Cash Buyers Statements

Reducing rate of interest is just one of one of the most common reasons to buy a home in cash money. Throughout a 30-year home loan, you could pay 10s of thousands or also numerous hundreds of dollars in complete interest. Additionally, your purchasing power increases without any funding backups, you can discover a more comprehensive selection of homes.

The largest danger of paying money for a home is that it can make your funds volatile. Tying up your liquid assets in a property can lower economic adaptability and make it extra tough to cover unanticipated expenditures. In addition, tying up your cash implies losing out on high-earning financial investment chances that could produce higher returns in other places.